News & Insights

News & Insights

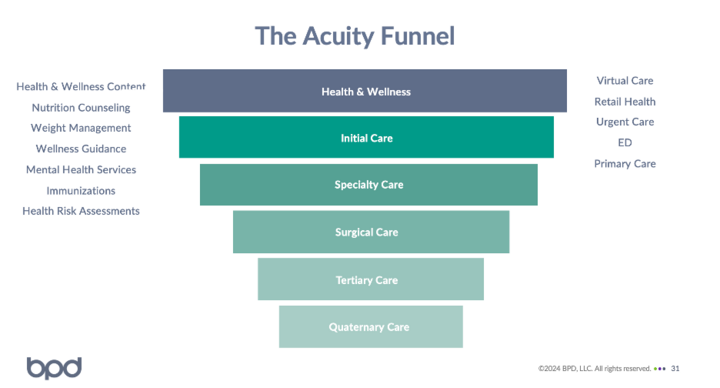

Picture the healthcare continuum. Now, flip it on its side and imagine it in the shape of a funnel: health & wellness services at the top, leading to initial encounters, specialty care, surgical care, tertiary, and quaternary care.

Guess what? Healthcare operates… like a funnel. Patients typically enter the system through everyday health services like primary care or women’s health, and are referred to high-acuity, high-margin services when needed, like orthopedics, oncology, or neurology. Surprise, surprise.

But the healthcare system isn’t structured that way. Hospitals and health systems prioritize high-margin, high-acuity services while new entrants and retail health brands vye for the top of the acuity funnel. Think: Amazon / One Medical, Apple, CVS Health, Walgreens, and Optum; as well as niche wellness services like Forward, Prenuvo, Parsley Health, and more.

Just look around Las Vegas: How many new primary care models and wellness services have been launched at HLTH alone?

Why? Because the top of the acuity funnel is valuable space. Whoever ultimately owns that space owns the consumer relationship. And that’s the prize.

So, what are the implications of The Funnel Wars?

- No clear winners yet: New entrants and retail health players have taken one steps forward, two steps back this year. With Walmart Health closing its centers, Walgreens’ struggling business, and Teladoc and Amwell retreating, the space for healthcare disruption is still wide open.

- Bifurcation of the healthcare system: A few large, integrated health systems might emerge as dominant players, offering a comprehensive suite of services from wellness to high-acuity care. But more likely, traditional healthcare players may be relegated to downstream services — become “giant ICUs on the hill.”

- Culture vs medical knowledge: As Russ Myers, Executive Director of Brand Strategy and Innovation at CVS Health points out in Joe Public 2030, “those who have to gain knowledge will get their faster than those who have to shift culture.” Retailers have a consumer-focused culture already—and the consumer data to back it up. Hospitals, health systems, and clinical providers have robust medical knowledge, but lack consumer-first culture. Retailers can hire CMOs and clinicians; but can health systems shift culture?

We want your take…

- As new entrants continue to enter healthcare, what will it take for them to dethrone legacy players?

- Can healthcare at the top of the acuity funnel ever be truly shoppable?

- With Walmart Health closing their centers earlier this year, Walgreens closing stores, and Optum shutting down telehealth, which new entrants (if any) do you think have the ability to win?

- What does the future of retail health look like?

- What does a strong partnership look like between new entrants and traditional healthcare providers?

- Should new entrants leverage the traditional reimbursement model, focus on OOP payment, explore new payment models, or some combination of these?

- How can marketers continue to stress the importance of top-of-funnel offerings to the organization?

Stay in Touch

Stay in Touch

Receive our updates, industry news and insights.